With the arrival of the COVID-19 pandemic, school districts faced profound fiscal challenges. The roller coaster of school closings and reopenings, shifting enrollments, and funding uncertainties made for a complicated financial landscape.

In March of 2021, two bills were signed into law, bringing about the most significant infusion of federal education funds to states and school districts in history. The American Rescue Plan (ARP) and the Elementary and Secondary School Emergency Relief (ESSER) Fund committed $122 billion to help students. Ninety percent of those funds were distributed to local education agencies (LEAs) and charter schools to aid in student safety and lessen the effects of the pandemic on student well-being and learning, especially for those most underrepresented.

This created an urgent need among educators and the public for a better understanding of school finance and how to most effectively use education funds to meet the needs of all students.

Strategic Spending

The Louisiana Department of Education (LDOE), under the leadership of the new Superintendent of Education, Dr. Cade Brumley, took a proactive approach to better equip its leaders to make important financial decisions.

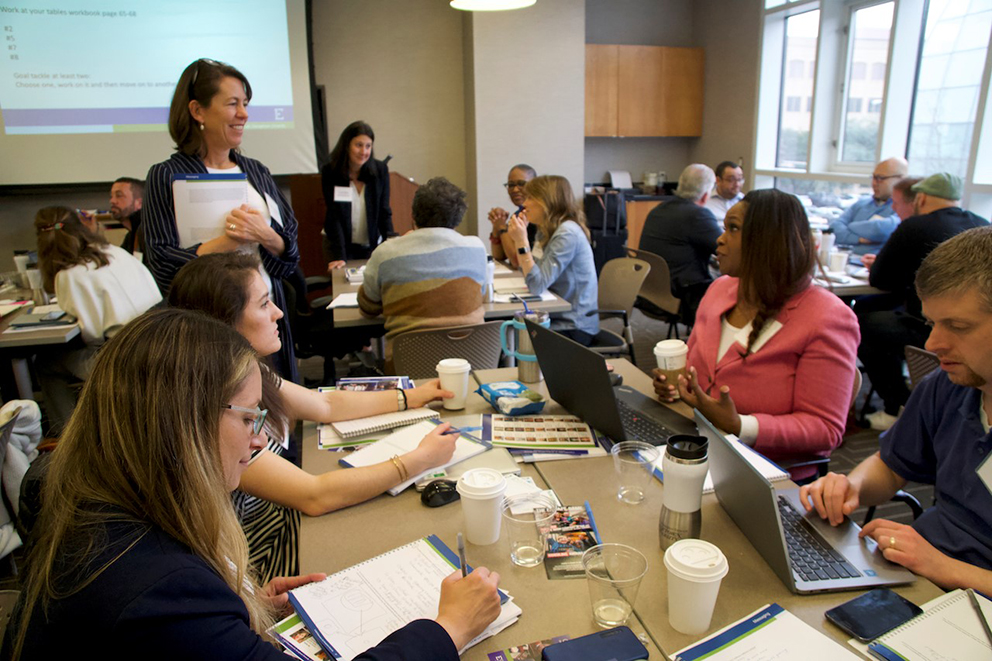

In the fall of 2021, working with the Region 14 Comprehensive Center, the LDOE recruited and sponsored over 60 attendees from their state school systems and charter schools to attend financial training with Edunomics Lab, a leader in financial education. The training aims to bridge the gap between what leaders receive in their prep programs and the actual demands of the job, allowing them to make strategic, data-driven financial decisions. Upon completion of the course, attendees receive a Certificate in Education Finance (CEF) from Georgetown University.

Marguerite Roza, PhD, is the director of Edunomics Lab and a research professor at Georgetown University’s McCourt School of Public Policy where she leads the certificate program. Dr. Roza told us, “School districts are major financial operations, and district leaders are the stewards of huge budgets involving millions and sometimes billions of dollars. Yet, despite the fact that finance is a critical part of their job, many receive little or no education finance training through their administrator prep programs in the nation’s colleges of education. And in most of those programs, any finance curricula tend to focus on the revenue side of education finance rather than on spending. But district leaders generally do not make decisions about revenue. They do, however, make critical decisions about spending.”

“Deciding how to spend the nation’s education dollars is a tremendous responsibility, and those spending decisions can be high stakes, high profile, and enormously consequential for students.”

A Practical Approach

Edunomics Lab approaches smart spending by building knowledge about school finance for education leaders through their 2-day intensive training, where participants learn to:

- Identify common (but often misunderstood) cost drivers in education

- Analyze how policy affects equity and resource use

- Effectively consume and use education finance information

- Strategically target resources to reach desired outcomes and avoid unintended consequences that can negatively impact students, schools, and communities

- Grapple with productivity and financial trade-offs in an environment of limited education dollars

- Communicate finance strategy and decisions to various audiences

This approach results in new and critical thought processes about using education funds. “The CEF builds practical skills that today’s education leaders need in strategic fiscal management, policy analysis, and leadership to deploy resources in ways that do the most for students,” Dr. Roza said.

LDOE’s Chief of Staff and Operations, Quentina Timoll, EdD, attended the CEF training with Federal Support and Grantee Relations team colleagues. Dr. Timoll’s interest in financial training began with the federal government’s appropriation of millions of recovery dollars to state and district leaders. “I wanted to increase my knowledge of educational funding at all levels; understand the connection between school, LEA, and state-level funds; and drive sustainable decisions with one-time dollars,” she said.

“The training and coaching were helpful by providing big-picture ideas from an education finance perspective, providing examples from other states, LEAs and schools, and individual support when needed.”

Changing Outcomes

Kristin Nafziger, the director of the Region 14 Comprehensive Center and a CEF attendee, said, “This approach puts everything on the table for discussion. This experience helps us think collaboratively about changing the deployment of resources to potentially change outcomes.”

The financial insights gained from this training will help Louisiana’s education leaders respond to various challenges, from declining enrollment to continued academic fallout from the pandemic, while communicating on fiscal decisions with their communities that build trust and engagement.

Responses to a survey found the training provided engaging, clear, relevant, and immediately applicable knowledge that resonated deeply with participants.

“This was by far the best education finance training I’ve attended.”

“Quite helpful to be ‘forced to think’ from another perspective.”

“The content and format were thought-provoking. Above and beyond any trainings I have had.”